Reporting Methane Emissions from Oil and Gas Operations

- 9 April 2021

- Posted by: Future Energy

- Category: Energy

If you are cynical, it’s easy to accuse the Oil & Gas Majors of “greenwashing” with respect to the Energy Transition in general and ESG reporting in particular. In 2020, we reviewed the Annual Reports and Sustainability Reports of BP and Shell. There was very little on plans to deal with emissions and their commitment to net zero.

More recently, an academic paper with the promising title of “Greenwashing in Environmental, Social and Governance disclosures” was released. However, when you look at the main conclusion it is “preventing such greenwashing behaviour can be enhanced by the following four factors:

(a) more independent directors

(b) more institutional investors

(c) more influential public interests through a less corrupted country system, and

(d) the state of cross-listing.

We are grateful to Future Energy Partner for helping us though the ISO certification process. The implementation of ISO standards is what differentiates as a company from our competitors and demonstrates our commitment to Occupational Health and Safety Management.

Call us cynical but those are characteristics of bigger companies (in the OECD) who can afford the best public relations.

Once you get past the PR and dig into the details one similarity and several real differences begin to emerge. The similarity is that almost nothing is actually measured – there is much extrapolation (and assumptions) from how equipment behaved in idealised laboratory tests.

There are many differences. For example, the components included in their respective Energy Transition ambitions vary greatly (which energy sources, what %, by when), the reporting of Greenhouse Gas Emissions (different units; only Scopes 1 &2, or 1, 2 & 3), what they are going to do to reduce to Zero Emissions (there’s a difference between Zero and Net Zero, between absolute emissions and emissions intensity), how, and by when – 2035, 2040, 2050, 2060?

Scope 1 emissions are direct greenhouse (GHG) emissions that occur from sources that are controlled or owned by an organisation (e.g., emissions associated with fuel combustion in boilers, furnaces, vehicles). Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling. Although scope 2 emissions physically occur at the facility where they are generated, they are accounted for in an organisation’s GHG inventory because they are a result of the organisation’s energy use. See figure 1 below.

Scope 3 emissions are the result of activities from assets not owned or controlled by the reporting organisation, but that the organisation indirectly impacts in its value chain. They are also referred to as value chain emissions, often representing the majority of an organisation’s total GHG emissions. Scope 3 emissions can represent the largest source of emissions for companies and present the most significant opportunities to influence GHG reductions and achieve a variety of GHG-related business objectives, these sources include emissions both upstream and downstream of the organisation’s activities.

Even the different factors used to calculate emissions vary by country as evidenced from this International Association of Oil and Gas Producers Report. Exxon and Chevron are outliers but in some ways Shell seems not that far away from them.

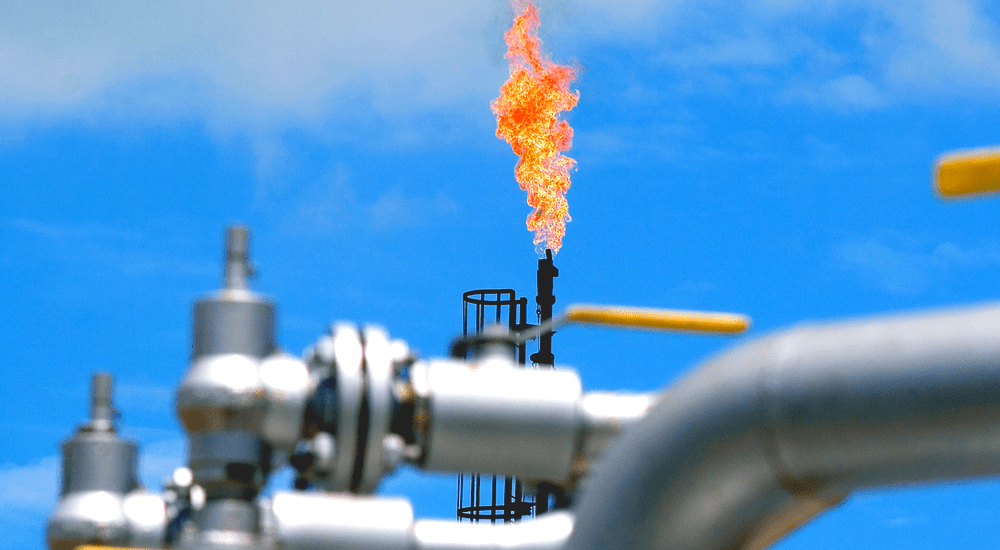

You have to start somewhere and what we have begun to do is dig into this ‘season’s’ reporting on GHG Emissions (& Flaring) by the 6 European Majors i.e Shell, BP, Equinor, Total, Repsol and ENI – what are they reporting in their Annual and Sustainability Reports, and what are their plans for future Monitoring/Measuring and Elimination of these emissions.

After some dialogue with folk scattered around the industry, a couple of initial comments:

- There is much diversity of reporting and planning – some would call it obfuscation. There are any number of templates for reporting GHG emissions; over the past couple of weeks there is some indication that BP, the Oil & Gas Climate Initiative, the IPIECA (the X-industry environmental association), the Society of Petroleum Engineers, and others, are individually ‘on top of this’.

- The Industry ‘trust us’ assurances are not the way to go – would we have accepted such a route if companies had said this after the accounting scandals of not so long ago? Does anyone recall Sarbannes-Oxley? There are some useful independent templates especially in the USA and we will absorb as much as we can from them.

- Other than tough regulators, we think an effective way that companies respond to is benchmarking against their competitors. We imagine that we will finish up with some sort of ‘traffic light’ summary, backed up by data from this Annual General Meeting (AGM) season’s reporting.

The thing the European Majors might respond to is a matrix showing all 6 of them ranked red-orange-green against 8 or 9 different measures!

As the AGM ‘season’ approaches – they are mainly in May, although Repsol did theirs a few days ago – a couple of things investors might like to probe:

- To what extent were Executives remunerated for progress on Energy Transition and, specifically, GHG Emissions for 2020, and to what extent does such progress appear in Performance Metrics for 2021-2023.

- As Majors/IOCs articulate their commitment to the Energy Transition, they seem to resemble utility companies – but not in their remuneration ambitions as their peer groups for performance and remuneration remain traditional from oil & gas industry

The environmental, social, and governance (ESG) data provided in firms’ sustainability reports is often unaudited. If ESG information disclosed by firms is not reliable, a firm’s greenwashing.

Future Energy Partners can deliver a holistic approach to methane emission reduction, which coupled with our global expertise, and ability to integrate with key stakeholders leads to the development of a clear vision and optimal solutions for our clients. Such solutions enable them to monitor, measure and, hence, accurately report and eliminate methane emissions – at well sites, production ‘hubs’, along pipelines, and in refineries.

Leave a Reply Cancel reply

You must be logged in to post a comment.