Environmental, Social and Governance Investment – getting it right

- 11 March 2021

- Posted by: Future Energy

- Category: Energy

ESG - Hybrid Investment Strategies

Environment, Social and Governance(ESG) has risen to the top of the agenda for investors in the past year. Is ESG reporting by companies meaningful? Is it truly representative of in-country, on the ground operations? Having a robust ESG roadmap provides strategic and operational protection for the Four Primary Elements of a frontier investment.

1) The core business of the investment itself,

2) The people it effects,

3) The governance required to support it,

4) The natural environment within which everything operates.

We are grateful to Future Energy Partner for helping us though the ISO certification process. The implementation of ISO standards is what differentiates as a company from our competitors and demonstrates our commitment to Occupational Health and Safety Management.

Without such proactive hybrid approach an investment process has very little protection against ground-based failure, with a coordinated and proactive ESG roadmap and management plan, an investor can help create the optimum setting for their own financial success alongside making an important contribution to the planet.

It is well understood that proactive ESG programmes have greater capacity to deliver such requirements as the UN Sustainable Development Goals and the IFC Performance Standards through operationalising the capacity to generate stewardship-led risk adjusted returns. The UN Sustainable Development Goals capture the connections among the various elements that can lead to a viable future for the people on this planet (See Figure 1). In emerging markets these connections are even more critical for sustainable investing.

The need to live more sustainably is now universally accepted. We have become far more aware of what we need to do to help secure our future on this planet. Lessoning the reliance on single use plastics, developing cleaner forms of energy and accepting the part that nature plays in our own health and prosperity have all contributed to new thinking and a capacity to influence our own human trajectory. However, the chasm between thinking and implementing is still very wide.

ESG and Socially Responsible Investing – A Priority for Front Line Sustainability

Investors are becoming much more active in influencing companies that they are invested in when it comes to ESG links to company performance. Shareholder proposals to Annual General Meetings (AGM) are getting more support up to 30% for AGM Resolutions in 2019 as evidenced by the following chart from Morningstar.

Figure 2 – 16 Year Trend in Average Support for Resolutions Addressing Environmental and Social Issues

A consistent reporting framework is evolving for Greenhouse Gases (GHG), just like the rest of ESG. Figure 3 and figure 4 below, from MSCI is one analysis that evaluates relevance of various key performance indicators for the portfolio of companies being considered both for Environmental and Social issues.

How can we deliver ESG robust investments?

Providing ESG compliance

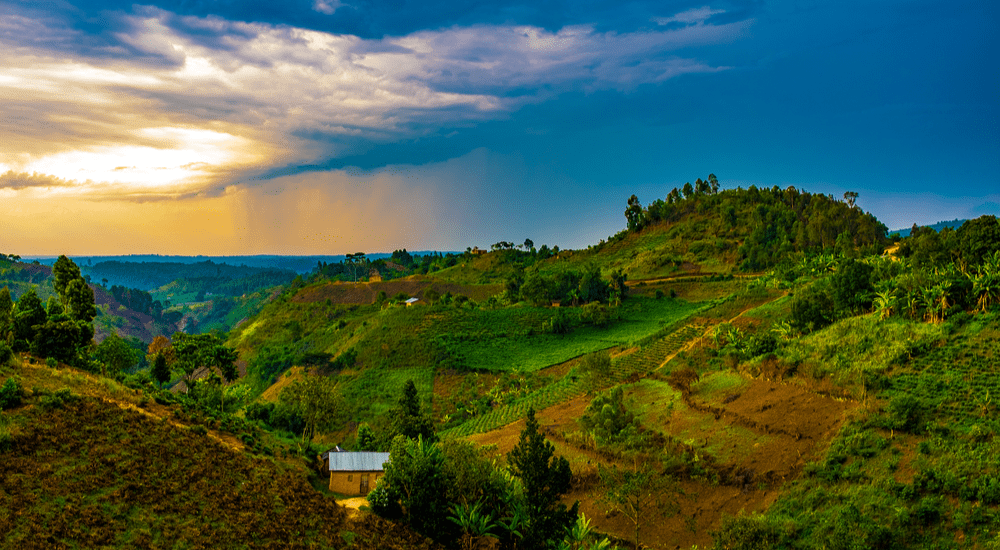

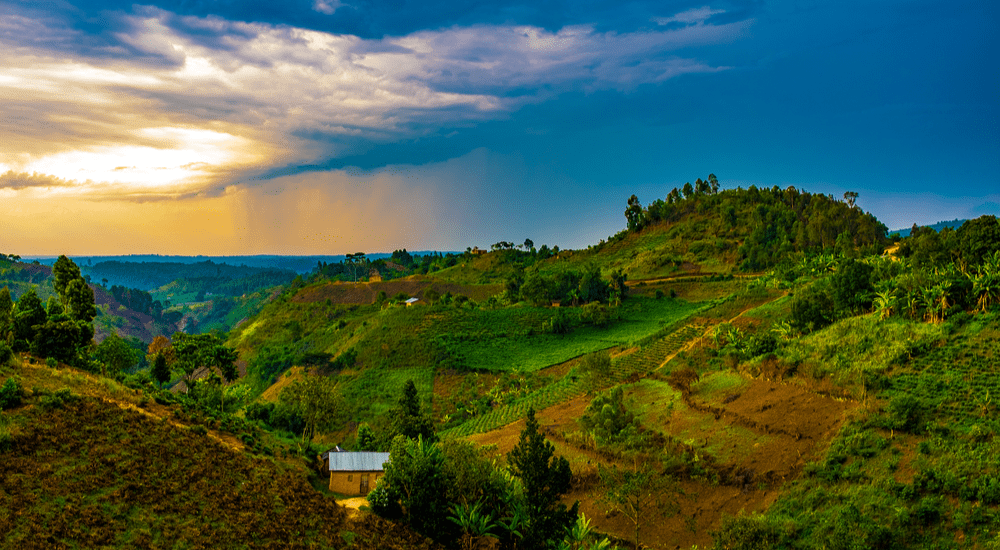

An investment must be supportive of its objectives in a sustainable way it if wants to succeed, in todays world this is most tangibly pronounced in the frontier and emerging markets where delivery can face a plethora of challenges. Operating sustainably requires a holistic approach from a collaboration of different sectors across society such as Environmental, political (regional and state), social/community (local human terrain), business and security.

ESG ensures that the environment is resilient enough to support investment activities without being negatively affected, directly or indirectly. It assists an investment to operate in a continuous and productive manner implementing best practice and adhering to sustainable protocols such as the Equator Principles and the IFC requirements.

Protecting license to operate

Engagement and maintenance of strategic relationships is an essential component of cross-cultural business as it provides a platform for ongoing dialogue and it helps avert suspicion. Global ESG investments must ensure that governance and mitigating corruption is a priority. The relationship between host national governments, regional administrations and local communities must be kept at a level whereby open dialogue and proactive partnerships bolster and protects an investments licence to operate, whilst at the same time adhering to best practice.

Such proactive relationships will provide the type of backdrop required for ongoing implementation of governance frameworks such as the Extractive Industry Transparency Initiative(EITI), focusing on providing transparency on the sources and uses of revenues.

Daily maintenance of strategic relationships and community engagements is an essential requirement when entering frontier and emerging markets. Information must be recorded and analysed using a database to ensure that all business, official and cultural dimensions are monitored and managed adequately promoting high satisfaction levels amongst the stakeholder parties and developing an inclusive and diverse joint venture culture that will lead to better outcomes.

Gathering targeted ESG data

A difference between ESG investing in established markets versus in frontier and emerging markets is the availability of useable data. The reasons for this disparity is that the business environments and the human cultures differ quite considerably. This is most stark in the rural areas of the frontier and emerging states where data is most scarce and usually will have to be generated from the ground, and its particularly relevant in supply chain management.

knowledge and understanding are vital elements of any business, this is amplified when doing business outside of a home culture when ESG compliance is essential and data required to demonstrate transparency, accountability and to ensure the correct operational decisions are being made.

Fora frontier or emerging market investment to generate optimum financial and ESG returns it must have access to an accurate and evolving picture of the holistic pace that the business or project inhabits, from the geographical, environmental, human, political, security, cultural, business, logistical and economic perspectives. The end result will provide the basis for on-going situational analysis and the development of proactive investment strategies.

What is an ESG roadmap, why is it important and how does it work?

An ESG Roadmap operates through the creation of a bespoke proactive and holistic stewardship plan that has been extensively researched, analysed and developed, enabling it to guide, advise, monitor and evaluate actions and sustainable outcomes of the business throughout its life.

A Roadmap includes detailed examination of the motivation for change that justifies the journey from Point A) pre-breaking ground to Point B) a position whereby a project/business is operational with an agreed level of natural and human sustainability and where investment stability is attained, maintained, monitored and analysed in situ.

An effective ESG Roadmap, alongside a working database, is a continually evolving framework that provides times, dates, historic data, monitoring data, engagement data, relationship mapping and a source from which analysis, reports, recommendations and predictions can be calculated. Without such a capacity best practice delivery cannot be demonstrated, informed decisions cannot be made, stakeholder relationships managed, nor challenges mitigated.

A Roadmap is managed by a dedicated team to identify and manage the engagement with specific social and community groups through positive influence to promote partnerships and support the investment. It will outline environmental and social research assessments that will need to be conducted and monitored to ensure that sustainable practices can be implemented and maintained.

The proximity of a project to the local community and the livelihood that they derive from their natural environment is demonstrated in this excerpt from the CNOOC ESIA. On the shores of Lake Albert local fishermen, farmers and the commercial oil industry will need to be aware of the impact on each other and find a way to work profitably and sustainably together.

To ensure the political and operational security of an investment is maintained a robust roadmap must identify and aim to understand key personalities in the official, business and community spheres of influence who will be important as strategic partners, supporters or key stakeholders, essential to the enhancement of an investment financial performance.

Operationalising ESG in a frontier or emerging markets needs to be a specialist undertaking if it is to support an investment successfully, where management, mitigation and adjustment of environmental and social risk needs to be the responsibility of a dedicated team rather than being an extra unwanted responsibility for a core business manager.

A frontier ESG investment process should include a dedicated, multi-disciplined, team consisting of a combination of international and host nation expertise, able to deliver the on-going ESG requirements and to identify and adjust potentially costly and debilitating risks such as:

- Threats pertaining to the withdrawal of an investments licence to operate,

- The influence of community and workforce by destabilising forces

- Unsustainable environmental practices

- Health related threats

- Bad governance

- Cultural-mismanagement

- Corruption

- Political subversion

- Negative exposure

- Union-mismanagement.

Frontier ESG Advisory has developed a proactive stewardship framework called InveSTABLE which operationalises ESG so that it can be applied to managing risk through the development and maintenance of investment supportive sustainable human and natural environments. Future Energy Partners provide the energy and carbon management components of InveSTABLE ensuring that it is a fully holistic solution.

Future Energy Partners has extensive ‘on the ground’ experience working with stakeholders ( communities, partners, suppliers, governments, NGOs, investors and lenders) to identify the risks with natural resource developments and to manage those risks working with companies such as Frontier ESG. Environmental impact including climate change, Social impact and Governance are high priority items for investors in 2021.

Ian Saunders, has spent over twenty-five years in the environmental, development, security and business sectors across the frontier and emerging states of Africa and Asia, he is the architect of the Investable Solution, a proactive holistic approach to todays hybrid investment challenges.

Leave a Reply Cancel reply

You must be logged in to post a comment.